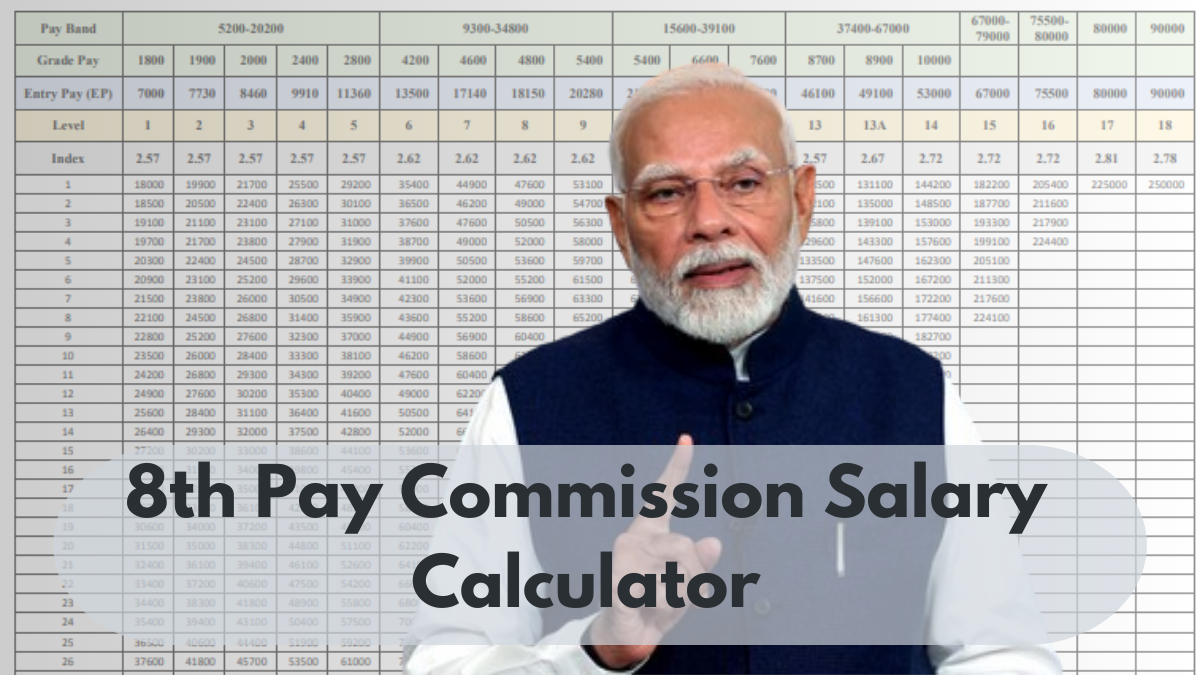

The 8th Pay Commission Salary Calculator is a cutting-edge tool developed to assist central government employees in projecting their revised salaries. By considering key components such as the anticipated fitment factor of 2.86, updated pay matrices, and revised allowances, this tool offers invaluable insights into potential earnings. This comprehensive guide explores how the calculator works, the anticipated changes under the 8th Pay Commission, and the broader implications for government employees’ financial well-being.

How the 8th Pay Commission Salary Calculator Works

Using the salary calculator involves a few simple steps that allow employees to estimate their revised pay, factoring in updates expected under the 8th Pay Commission. Here’s a detailed breakdown:

Step 1: Enter Your Current Basic Salary

The basic salary forms the core of your income, excluding additional allowances like DA, HRA, and travel benefits.

Example: If your current basic pay under the 7th Pay Commission is ₹18,000, input this amount into the calculator.

Step 2: Select the Expected Fitment Factor

The fitment factor is a multiplier used to calculate the revised basic salary. For the 8th Pay Commission, the fitment factor is projected at 2.86, marking a significant increase from the 7th Pay Commission’s 2.57.

Step 3: Set the Expected Dearness Allowance (DA) Percentage

The DA adjusts employee salaries to account for inflation. By 2026, this percentage is expected to reach 70%.

Step 4: Calculate Your Estimated Salary

The calculator generates the following estimates:

- New Basic Salary: Calculated by multiplying your current basic salary with the fitment factor.

- Dearness Allowance (DA): Calculated as a percentage of the new basic salary.

- Total Salary: The sum of the new basic salary and DA.

Example Calculations

Here are sample calculations to illustrate the financial impact of the 8th Pay Commission:

| Employee Level | Current Basic Salary | Fitment Factor | New Basic Salary | DA (70%) | Total Salary |

|---|---|---|---|---|---|

| Level 1 Employee | ₹18,000 | 2.86 | ₹51,480 | ₹36,036 | ₹87,516 |

| Level 2 Employee | ₹19,900 | 2.86 | ₹56,914 | ₹39,840 | ₹96,754 |

| Higher-Level Officer | ₹1,23,100 | 2.86 | ₹3,51,066 | ₹2,45,746 | ₹5,96,812 |

These projections provide a glimpse into how salaries may evolve, subject to official government announcements.

Key Features of the 8th Pay Commission

The 8th Pay Commission is anticipated to introduce transformative changes to central government salaries and pensions. Here are its primary features:

1. Higher Fitment Factor

The expected increase in the fitment factor to 2.86 will result in substantial salary hikes. For instance:

- Current Minimum Salary (7th Pay Commission): ₹18,000

- Expected Minimum Salary (8th Pay Commission): ₹51,480

2. Increased Dearness Allowance

The DA is forecasted to reach 70% by 2026, ensuring that salaries remain aligned with inflation.

3. Improved Pension Framework

Pensioners are set to benefit significantly from these changes:

- Current Minimum Pension (7th Pay Commission): ₹9,000

- Expected Minimum Pension (8th Pay Commission): ₹25,740

The increased DA will further enhance pension payouts, providing greater financial security for retirees.

Benefits of the 8th Pay Commission

The 8th Pay Commission is expected to bring a host of advantages for government employees and pensioners:

- Enhanced Salaries: The revised pay structure will lead to a significant boost in income.

- Improved Pensions: Retirees can look forward to better financial stability with higher pensions.

- Inflation Protection: Regular DA adjustments will help salaries keep pace with inflation, preserving purchasing power.

- Updated Allowances: Expect updates to allowances for housing, travel, and healthcare to reflect modern needs.

What is the 8th Pay Commission?

The 8th Pay Commission is the upcoming framework for revising salaries and pensions for central government employees. It aims to introduce a:

- New fitment factor for salary adjustments.

- Revised pay matrix across all levels.

- Updated DA rates and allowances, ensuring fairness and inflation protection.

While the exact implementation date is yet to be announced, it is widely speculated to take effect by 2026.

Frequently Asked Questions

1. When will the 8th Pay Commission be implemented?

Although an official date has not been confirmed, the 8th Pay Commission is expected to be implemented by 2026.

2. What is the projected fitment factor for the 8th Pay Commission?

The fitment factor is projected to rise to 2.86, offering a substantial increase in basic pay.

3. How will pensioners benefit from the 8th Pay Commission?

Pensioners will experience higher minimum pensions, rising from ₹9,000 (7th Pay Commission) to ₹25,740, along with increased DA.

4. What is the significance of the Dearness Allowance (DA) in the 8th Pay Commission?

The DA is expected to reach 70% by 2026, ensuring that salaries and pensions keep pace with inflation.

5. Who can use the 8th Pay Commission Salary Calculator?

The calculator is designed for central government employees who wish to estimate their revised salaries and allowances under the upcoming framework.

Click Here To Know More

I am a passionate technology and business enthusiast. I constantly explore the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.